A calculation exists to determine the value of items ready for sale. This computation accounts for all costs associated with production, including raw materials, direct labor, and manufacturing overhead. For example, a... Read more »

The calculation that determines the value of completed products available for sale at the conclusion of an accounting period is a critical component of financial reporting. It reflects the sum of direct... Read more »

Determining the value of completed products ready for sale involves assessing the costs accumulated throughout the production process. This calculation encompasses direct materials, direct labor, and manufacturing overhead applied to the completed... Read more »

The valuation of completed products ready for sale involves determining the total cost associated with manufacturing those items. This computation necessitates accounting for all direct materials, direct labor, and manufacturing overhead incurred... Read more »

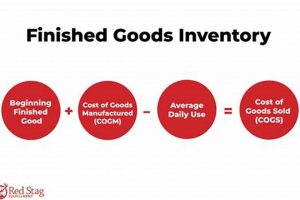

A fundamental calculation provides insight into the value of completed products ready for sale at any given time. This calculation factors in the beginning inventory balance, the cost of goods manufactured during... Read more »

Completed products, ready for sale to customers, represent a significant asset for manufacturing and retail operations. These items have undergone all stages of the production process and are held in storage awaiting... Read more »

Determining the value of completed products ready for sale, held by a company, is a fundamental aspect of inventory accounting. This process involves assessing the costs associated with all manufactured items awaiting... Read more »

The calculation to determine the value of completed products ready for sale involves summing the cost of beginning finished goods inventory, the cost of goods manufactured during the period, and then subtracting... Read more »