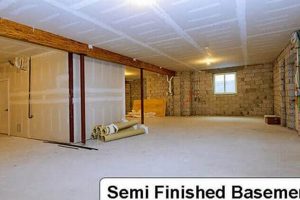

A basement space that has been improved beyond its basic structural form to create a habitable living area can significantly impact property taxes. This transformation generally involves adding features such as finished walls, flooring, a ceiling, electrical wiring, plumbing, and sometimes even heating and cooling systems. When these elements are present to a certain extent, the local tax assessor may re-evaluate the property’s overall value, potentially leading to an increase in property tax obligations. For example, a basement converted into a functional family room, complete with carpeting, drywall, and recessed lighting, is more likely to be considered in a property tax assessment than an unfinished storage space.

The presence of livable square footage increases the perceived value of a residence, and thus often leads to higher assessed property taxes. Historically, basements were often excluded from property tax calculations, or given reduced weight. However, as homeowners increasingly invest in improving these spaces, municipalities are adjusting their assessment practices to capture the added value. Understanding this potential financial impact is crucial for homeowners considering basement renovations. Accounting for the potential tax implications allows for more informed decisions regarding home improvement projects.

The following sections delve into the specific criteria used by tax assessors to determine the taxable status of a basement. It will address how the extent of finishing affects assessments, how permits play a role, and strategies for understanding and potentially appealing property tax valuations.

Tips Regarding the Tax Implications of a Finished Basement

Navigating the property tax implications associated with basement finishing requires a proactive and informed approach. Consider the following tips to better understand and manage these potential financial obligations.

Tip 1: Research Local Assessment Practices: Contact the local tax assessor’s office to understand their specific criteria for evaluating finished basements. These standards vary considerably by jurisdiction.

Tip 2: Document the Project Thoroughly: Maintain detailed records of all renovation expenses, including receipts, contracts, and photographs, to potentially support a future appeal if necessary.

Tip 3: Understand Permit Requirements: Obtain all required building permits before beginning any basement finishing project. Unpermitted work can lead to fines and increased scrutiny from tax assessors.

Tip 4: Assess the Level of Finishing: Be aware that features such as a fully functional kitchen, bathroom, or separate entrance may significantly increase the assessed value of the basement.

Tip 5: Compare to Similar Properties: Research the assessed values of comparable homes in the neighborhood with finished basements to gauge potential tax implications.

Tip 6: Consider Incremental Finishing: Explore the option of finishing the basement in stages, rather than all at once, to potentially mitigate immediate tax increases.

Tip 7: Understand the Appeal Process: Familiarize yourself with the local property tax appeal process in case the assessment following the basement finishing seems excessive.

These tips offer guidance in managing the tax implications associated with improving basement spaces. By proactively researching local regulations and meticulously documenting the project, homeowners can better prepare for potential changes in property tax assessments.

The subsequent sections will explore common misunderstandings surrounding this topic and outline steps to ensure compliance with all applicable regulations.

1. Habitable Living Space

The creation of a “habitable living space” within a basement directly influences its classification and, consequently, its property tax implications. Local tax assessors commonly evaluate basement areas based on their functionality and suitability for regular human occupancy. When a basement is transformed into a space that mirrors the features and amenities of living areas on the upper floors, it is more likely to be considered a finished area for tax purposes. For instance, a basement containing a bedroom, bathroom, and living room is substantially more likely to be assessed as finished than a basement used solely for storage.

The rationale behind this connection lies in the perception of increased property value. A habitable basement adds usable square footage and amenities to the home, thereby raising its potential market value. Assessors view these improvements as increasing the property’s overall appeal and functionality, justifying an increase in the assessed value and, correspondingly, property taxes. Consider a situation where a homeowner converts an unfinished basement into a self-contained apartment with a separate entrance. This improvement not only expands the living area but also creates the potential for rental income, further enhancing the property’s investment potential. Therefore, the tax assessor would consider such an upgrade a significant enhancement warranting reassessment.

In summary, the transformation of a basement into a habitable living space serves as a primary indicator for property tax assessors when determining whether a basement qualifies as “finished”. The presence of features that enable regular human occupancy, such as finished walls, flooring, heating, and plumbing, signals a substantial increase in property value. Consequently, homeowners must recognize that these improvements often translate into increased property tax obligations. Thorough research into local assessment practices and documentation of renovation expenses are crucial for managing potential financial impacts.

2. Permanent Improvements Present

The presence of permanent improvements is a crucial determinant in the classification of a basement as finished for tax purposes. These enhancements are not easily removable and contribute significantly to the overall utility and market value of the property. Their existence often signals a deliberate effort to transform the basement from a mere storage area into a functional living space, prompting a potential reassessment of property taxes.

- Finished Walls and Ceilings

The installation of drywall, paneling, or other finished wall and ceiling materials constitutes a permanent improvement. These materials enclose the space, providing insulation and a finished aesthetic similar to the upper levels of the home. This differs greatly from unfinished concrete walls and exposed joists, which are characteristic of unfinished basements. The presence of finished surfaces suggests an intention to create a habitable area, directly influencing its tax classification.

- Installed Flooring

Permanent flooring, such as tile, hardwood, laminate, or carpeting, is another significant indicator. Affixing flooring creates a more comfortable and functional environment, further distinguishing the space from a simple storage area. Unlike temporary floor coverings, installed flooring is typically regarded as a permanent fixture and considered in property tax assessments.

- Plumbing and Electrical Systems

The addition of plumbing fixtures, such as sinks, toilets, showers, or bathtubs, coupled with electrical wiring for lighting, outlets, and appliances, represents a substantial investment in the basement’s functionality. These systems are integral components of a finished living space. A basement with these utilities is more likely to be considered finished, leading to potential adjustments in property tax calculations.

- Heating and Cooling Systems

The installation of dedicated heating and cooling systems, whether through ductwork extensions or separate units, demonstrates an intent to create a comfortable living environment within the basement. These systems contribute significantly to the overall habitability of the space, solidifying its classification as a finished area. Consequently, assessors often factor this element into their valuation process, impacting property tax obligations.

These permanent improvements collectively contribute to the perception of a finished basement as a valuable addition to the property. They transform the space from a basic storage area into a functional living area, thereby increasing the property’s overall market value and potentially triggering a reassessment for tax purposes. The extent and quality of these improvements directly impact the assessed value and, consequently, the property tax burden.

3. Local Regulations Matter

Local regulations are paramount in determining the taxable status of a finished basement. Varying definitions and assessment practices across jurisdictions dictate how these spaces are evaluated, directly impacting property tax obligations. A comprehensive understanding of applicable local codes and guidelines is essential for homeowners considering or undertaking basement finishing projects.

- Definition of “Finished Space”

Local ordinances define what constitutes a “finished space” differently. Some jurisdictions may focus primarily on the presence of finished walls, flooring, and ceilings, while others consider the inclusion of plumbing, electrical systems, and HVAC as critical factors. These varying definitions mean a basement considered unfinished in one locality may be deemed finished in another, with corresponding tax implications.

- Permitting Requirements

Local building codes mandate permits for basement finishing projects. The requirements for obtaining these permits, including inspections and compliance with specific standards, can significantly influence the final assessed value. Unpermitted work may not only result in fines but also trigger a higher tax assessment upon discovery, as it indicates a deliberate effort to avoid regulatory oversight.

- Assessment Practices

Local tax assessors employ diverse methodologies for evaluating finished basements. Some may calculate the assessed value based on the square footage of the finished area, while others consider the overall quality of the improvements and the market value of comparable properties. These disparities can lead to significant differences in tax bills for similar basement renovations, underscoring the importance of understanding local assessment practices.

- Exemptions and Incentives

Certain jurisdictions offer exemptions or incentives for specific types of basement improvements. For example, some may exempt basements used solely for storage or offer tax credits for energy-efficient renovations. Awareness of these provisions can help homeowners minimize their tax burden and maximize the benefits of their basement finishing projects. It is crucial to research and take advantage of applicable local incentives.

In summary, local regulations serve as the foundation for determining whether a basement is considered finished for tax purposes. The definition of “finished space,” permitting requirements, assessment practices, and available exemptions all contribute to the final property tax assessment. Consequently, homeowners must consult local authorities and familiarize themselves with applicable codes to ensure compliance and effectively manage their tax obligations.

4. Permits are Required

The requirement for permits in basement finishing projects is inextricably linked to property tax assessments. Obtaining the necessary permits signifies adherence to local building codes and standards, influencing how the finished space is evaluated for tax purposes. This connection highlights the importance of understanding permit obligations when planning basement renovations.

- Compliance with Building Codes

Permits ensure that the basement finishing project complies with local building codes related to safety, structural integrity, and habitability. Inspections conducted during the permit process verify that the work meets these standards. A basement finished without proper permits may not meet code requirements, leading to safety hazards and potential legal liabilities. When the project is compliant, the tax assessor will factor in improvements based on the finished space increasing the value of the property.

- Documentation of Improvements

The permit application and approval process creates an official record of the improvements made to the basement. This documentation provides the tax assessor with detailed information about the scope and nature of the project, including the addition of finished walls, flooring, plumbing, and electrical systems. This record streamlines the assessment process and allows for a more accurate valuation of the finished space.

- Valuation and Assessment

Tax assessors use information from permit records to determine the increase in property value resulting from the finished basement. The assessed value directly impacts the property tax bill. By obtaining permits and ensuring compliance with building codes, homeowners provide assessors with the necessary information for fair and accurate valuation, potentially avoiding disputes or discrepancies in the assessment process.

- Legal and Financial Implications

Failure to obtain required permits can lead to fines, legal action, and the forced removal of unapproved improvements. Moreover, unpermitted work may not be covered by insurance policies, exposing homeowners to financial risks in the event of damage or loss. Obtaining the necessary permits protects homeowners from these liabilities and ensures that the finished basement is recognized as a legal and valuable part of the property, which will have affect on property tax.

The issuance of permits for basement renovations directly correlates with the assessment of property taxes, providing a transparent framework for municipalities to evaluate improvements and adjust valuations accordingly. This linkage underscores the significance of adhering to permit requirements as a fundamental aspect of responsible homeownership and sound financial planning. Without required permits, it will affect “what is considered a finished basement for tax purposes”.

5. Market Value Increase

An increase in a property’s market value following basement finishing is a primary driver for reassessment by tax authorities. The addition of usable, habitable space enhances a property’s desirability and, consequently, its market price. This perceived augmentation of worth directly influences property tax obligations.

- Added Living Space

Finishing a basement adds to the total livable square footage of a residence. This expansion directly contributes to the perceived value, as potential buyers often prioritize properties with ample living areas. For example, a home with a finished basement used as a family room or guest suite commands a higher price than an identical home with an unfinished basement. The increased square footage translates to a higher market value and, consequently, a potentially higher tax assessment.

- Improved Amenities and Functionality

A finished basement frequently includes amenities such as bathrooms, kitchens, or home theaters, enhancing the property’s overall functionality and appeal. These improvements contribute significantly to market value, attracting buyers seeking convenience and modern features. For instance, a basement equipped with a full bathroom and wet bar can greatly increase the property’s appeal to potential renters or multigenerational families. The enhanced functionality directly correlates with an increased market value and subsequent tax implications.

- Comparative Market Analysis

Tax assessors often use comparative market analysis (CMA) to determine property values. This involves comparing the subject property to similar homes in the area that have recently sold. If comparable homes with finished basements command higher sale prices, the subject propertys assessed value is likely to increase following a basement renovation. The CMA process provides objective data supporting the correlation between finished basements and elevated market values, leading to adjustments in property tax obligations.

- Investment Return

Homeowners frequently view basement finishing as an investment that increases their property’s long-term value. This investment not only enhances the quality of life but also provides a tangible return when the property is sold. The perception of a valuable asset motivates homeowners to invest in basement improvements, further driving the demand for finished basements and increasing their contribution to market value. The anticipated return on investment directly influences the decision to finish a basement, ultimately affecting the assessed property value and associated taxes.

The interplay between increased market value and completed basement modifications demonstrates the tax implications of improvements. By adding usable space to a structure’s value, assessors take note of the added value in any property tax evaluations. Therefore, careful consideration must be paid to a cost-benefit analysis of “what is considered a finished basement for tax purposes”.

6. Finished Square Footage

Finished square footage, referring to the measured area of a habitable basement space, is a primary determinant of its classification for tax purposes. An increase in finished square footage directly correlates with a potential reassessment of property value. Tax assessors rely on this metric to quantify the extent of improvements and determine the corresponding impact on the property’s overall worth. When a basement transitions from an unfinished storage area to a living space with finished walls, flooring, and a ceiling, the newly created finished square footage is added to the property’s total, potentially triggering a higher tax liability. For example, a property initially assessed based on 2,000 square feet on the main levels may see its assessment increase after the addition of 800 square feet of finished basement space.

The cause-and-effect relationship between finished square footage and property taxes is evident in numerous real-world scenarios. Homeowners who convert unfinished basements into functional apartments, home offices, or recreational areas are likely to experience an increase in their property tax bills. This is because the newly created finished square footage augments the property’s market value, as reflected in comparable sales data of homes with similar finished basements. The significance of finished square footage stems from its direct impact on a property’s appeal and functionality. A larger living area typically commands a higher price in the real estate market, justifying the reassessment and subsequent adjustment of property taxes.

In summary, finished square footage serves as a quantifiable measure of the improvements made to a basement, providing tax assessors with a tangible basis for property valuation. Understanding this connection is crucial for homeowners considering basement renovations, as it allows them to anticipate the potential financial implications and make informed decisions regarding their property improvements. While increasing finished square footage can enhance a property’s value and appeal, it also carries the responsibility of increased property tax obligations. Therefore, considering a “finished basement” means being cognizant of its measurable impact on the propertys assessment profile.

Frequently Asked Questions

The following questions and answers address common concerns and misunderstandings regarding the tax implications of finished basements.

Question 1: How does a municipality determine whether a basement is considered “finished” for property tax assessment?

Municipalities typically assess a basement’s finished status based on several factors, including the presence of finished walls, flooring, a ceiling, electrical wiring, plumbing, and heating/cooling systems. The specific criteria may vary by jurisdiction; consulting the local tax assessor’s office is advisable.

Question 2: Does simply adding drywall to a basement wall automatically classify it as finished for tax purposes?

Adding drywall is a factor, but not necessarily conclusive. Assessors consider the overall extent of finishing. If other essential features, such as flooring, heating, and electrical systems, are absent, the basement may not be considered fully finished.

Question 3: Are there any exemptions or deductions available for finished basements?

Certain jurisdictions offer exemptions or deductions for specific types of basement improvements, such as those related to energy efficiency or accessibility. Homeowners must research local regulations to determine eligibility.

Question 4: What happens if basement renovations are completed without obtaining the necessary permits?

Completing renovations without required permits can result in fines and legal action. Additionally, assessors may discover unpermitted work and reassess the property, potentially increasing the tax burden.

Question 5: If a finished basement is used primarily for storage, is it still subject to increased property taxes?

Even if a finished basement is used primarily for storage, the presence of finished features may still lead to a higher assessed value. The key factor is the potential for the space to be used as a habitable living area, regardless of its current use.

Question 6: How can a homeowner appeal a property tax assessment based on a finished basement?

Homeowners have the right to appeal property tax assessments they believe are inaccurate. The appeal process typically involves providing evidence to support a lower valuation, such as documentation of renovation expenses, comparable sales data, or an independent appraisal. Deadlines and procedures vary by jurisdiction.

Understanding these common questions allows homeowners to navigate the complexities associated with property taxes and completed basements with greater clarity.

The following sections will delve deeper into strategies for minimizing the financial impact of finished basements on overall tax obligations.

Conclusion

This exploration of “what is considered a finished basement for tax purposes” has revealed the nuanced factors that influence property valuation and subsequent tax obligations. The definition hinges on a combination of habitability, the presence of permanent improvements, adherence to local regulations requiring permits, the increase in market value due to improvements, and the quantifiable finished square footage. The interplay of these elements determines whether a municipality will reassess a property following basement renovations.

Given the potential financial impact, homeowners are urged to diligently research local ordinances, document all renovation expenses, and secure necessary permits before commencing basement finishing projects. The information provided herein serves as a foundational resource for making informed decisions and navigating the complexities of property tax assessments associated with finished basements. Proactive engagement with local tax authorities remains essential for ensuring compliance and effectively managing property tax responsibilities.